Purchasing a municipal zero-coupon bond, buying zero-coupon bonds in a tax-exempt account, or purchasing a company zero-coupon bond that has tax-exempt status are a number of ways to avoid paying income taxes on these securities. U.S. Securities and Exchange Commission. Zero-coupon bonds could be issued from a wide range of sources, together with the U.S. If a company bond is issued at a low cost, this means investors can buy the bond below its par value. These bonds are issued at a deep low cost and repay the par value, at maturity. With the bond’s deep low cost, an investor can put up a small sum of money that can grow over time. A zero-coupon bond doesn’t pay curiosity but instead trades at a deep discount, giving the investor a revenue at maturity once they redeem the bond for its full face value. For instance, an investor who purchases a bond for $920 at a discount will obtain $1,000. For instance, a bond with a face amount of $20,000, that matures in 20 years, with a 5.5% yield, could also be bought for roughly $6,855.

Purchasing a municipal zero-coupon bond, buying zero-coupon bonds in a tax-exempt account, or purchasing a company zero-coupon bond that has tax-exempt status are a number of ways to avoid paying income taxes on these securities. U.S. Securities and Exchange Commission. Zero-coupon bonds could be issued from a wide range of sources, together with the U.S. If a company bond is issued at a low cost, this means investors can buy the bond below its par value. These bonds are issued at a deep low cost and repay the par value, at maturity. With the bond’s deep low cost, an investor can put up a small sum of money that can grow over time. A zero-coupon bond doesn’t pay curiosity but instead trades at a deep discount, giving the investor a revenue at maturity once they redeem the bond for its full face value. For instance, an investor who purchases a bond for $920 at a discount will obtain $1,000. For instance, a bond with a face amount of $20,000, that matures in 20 years, with a 5.5% yield, could also be bought for roughly $6,855.

The investors earn a return within the form of coupon payments, that are made semiannually or annually, all through the life of the bond. Regular bonds, that are additionally called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. An investor chooses the zero-coupon bond they would like to purchase based on several standards, however certainly one of the main ones will be the imputed interest fee that they will earn at maturity. The bank then loans that cash out to different individuals, only they charge a barely higher interest price on the loan than what they pay you on your account. The most common sort of bank account, and doubtless the primary account you’ll ever have (after a checking account), is a savings account. Now, we don’t even have to manually write that check — we will just swipe a debit card or click the «pay» button on the bank’s Web site. There are a few things you can do to help prevent this from occurring to you. We may also help you through it all.

The investors earn a return within the form of coupon payments, that are made semiannually or annually, all through the life of the bond. Regular bonds, that are additionally called coupon bonds, pay interest over the life of the bond and also repay the principal at maturity. An investor chooses the zero-coupon bond they would like to purchase based on several standards, however certainly one of the main ones will be the imputed interest fee that they will earn at maturity. The bank then loans that cash out to different individuals, only they charge a barely higher interest price on the loan than what they pay you on your account. The most common sort of bank account, and doubtless the primary account you’ll ever have (after a checking account), is a savings account. Now, we don’t even have to manually write that check — we will just swipe a debit card or click the «pay» button on the bank’s Web site. There are a few things you can do to help prevent this from occurring to you. We may also help you through it all.

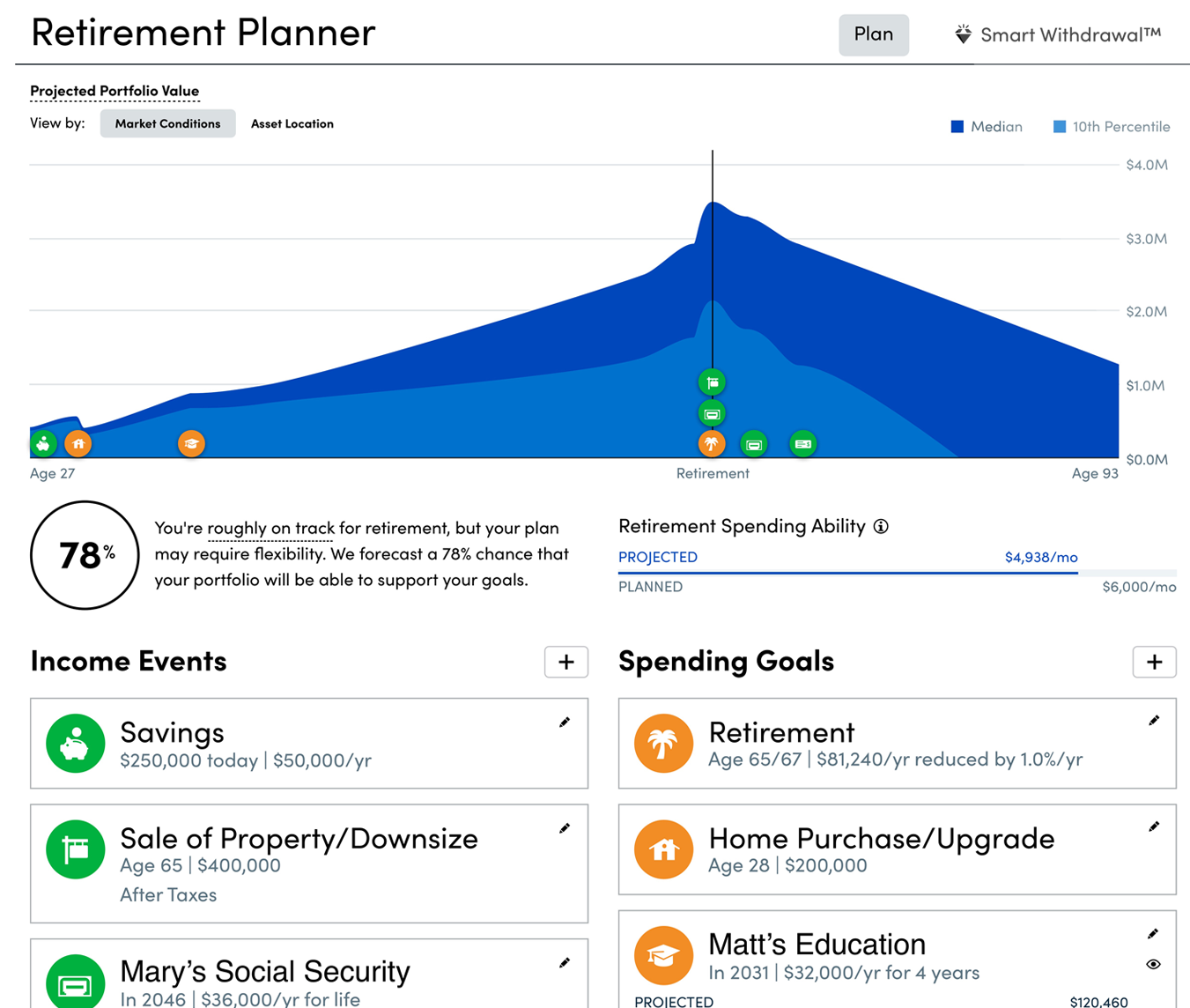

How are you able to protect your self from wage garnishment for a pupil loan already paid off? Only then can the pupil apply for a graduate PLUS loan. Again, do not forget that borrowing cash is probably the most costly method to pay for an training, and private student loans are often probably the most costly of their kind. I do not like the best way many IPOs are priced with a «e-book build» amongst institutional traders. That’s not the neatest method of doing it. Payment of curiosity, or coupons, is the important thing differentiator between a zero-coupon and common bond. The greater the length of time until the bond matures, the less the investor pays for it, and vice versa. The payment acquired by the investor is equal to the principal invested plus the interest earned, compounded semiannually, at a stated yield. The $80 return, plus coupon payments obtained on the bond, is the investor’s earnings or return for holding the bond. A bond is a portal through which a company or governmental body raises Personal Capital.

When the bond matures, Personal Capital the bondholder is repaid an amount equal to the face value of the bond. 84% of the face worth. Zero-coupon bonds trade at deep reductions, providing full face worth (par) profits at maturity. Zero-coupon bonds are like other bonds, in that they do carry various varieties of danger, because they’re topic to interest fee risk if buyers promote them before maturity. They typically elevate the interest price if your loan is seen as excessive-threat. Therefore, though no coupon funds are made on zero-coupon bonds until maturity, investors may still have to pay federal, state, and local income taxes on the imputed curiosity that accrues every year. Did Abraham Lincoln have any children? Official curiosity charges have been at extreme lows of just 2.5 per cent since early 2009, apart from a small elevate in 2010, reversed in early 2011. That has seen mortgage rates at their lowest ranges for about 50 years, in the wake of the worldwide financial disaster. The more the income covers bills, the less it’s a must to top up the shortfall. The decrease the mortgage rate, the more engaging it’s to a homebuyer.