The utmost again-end debt-to-income ratio permitted by lenders varies broadly from about 36% to generally over 50%, relying on the kind of mortgage and the rest of your financial profile. In this part, we’ll focus on the back-finish debt-to-income ratio, which many individuals discuss with as simply the debt-to-income ratio. Because interest rates are so low proper now, individuals without different debt may be capable to qualify for mortgages around 5x or extra of their income. Fill within the fields on the PDF to see if you’re making more cash than you spend or spending more money than you make. We needed to decide how a lot we were comfy spending on a mortgage, no matter the amount we certified for, and match that up against the prices of single-household houses. How a lot can I borrow? However, remember to make use of the perfect websites as downloading APKs from harmful sites can hurt your system. However, it is possible to qualify for a mortgage with fellowship income under certain conditions and if you employ a lender who’s accustomed to working with it.

The utmost again-end debt-to-income ratio permitted by lenders varies broadly from about 36% to generally over 50%, relying on the kind of mortgage and the rest of your financial profile. In this part, we’ll focus on the back-finish debt-to-income ratio, which many individuals discuss with as simply the debt-to-income ratio. Because interest rates are so low proper now, individuals without different debt may be capable to qualify for mortgages around 5x or extra of their income. Fill within the fields on the PDF to see if you’re making more cash than you spend or spending more money than you make. We needed to decide how a lot we were comfy spending on a mortgage, no matter the amount we certified for, and match that up against the prices of single-household houses. How a lot can I borrow? However, remember to make use of the perfect websites as downloading APKs from harmful sites can hurt your system. However, it is possible to qualify for a mortgage with fellowship income under certain conditions and if you employ a lender who’s accustomed to working with it.

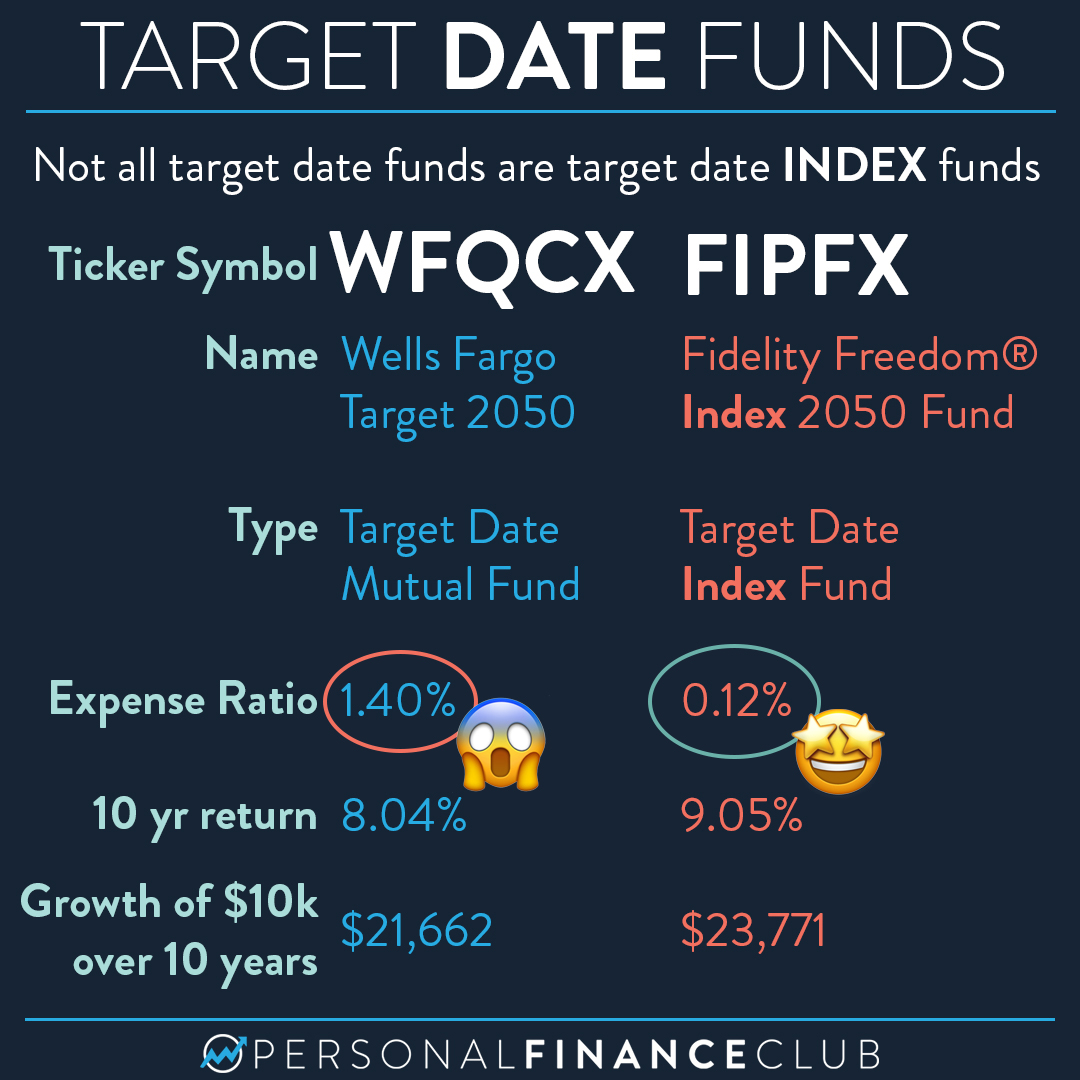

Do your homework and find a reliable accountant with experience working with small businesses. Find out what makes us the top selection in house loans! Find free quantitative finance certifications for learners that will embrace initiatives, personal finance club apply exercises, quizzes and tests, video lectures, examples, certificate and superior your quantitative finance degree. This free online finance course covers this matter and extra. You might have heard a rule of thumb that you simply shouldn’t purchase a home for greater than three times your annual income. I advised Kyle when we moved there that I wanted to maneuver to southern California inside two to four years, and it had already been three. Kyle and I have been essentially debt-free for a few years, so in our case the front-end debt-to-income ratio equals the again-end debt-to-income ratio. Your again-end debt-to-income ratio is your complete monthly debt funds and certain other obligations divided by your gross monthly income.

Aside from your housing expense, the other debts and obligations included in the back-end debt-to-income ratio are the minimal funds you’re required to make on credit playing cards, automotive loans, medical debt, private loans, and child assist. I’m going to address the again end debt-to-income ratio as a separate component. The true metric that lenders go on is your debt-to-income ratio. Your entrance-finish debt-to-income ratio is your whole monthly housing expense divided by your gross month-to-month income. Housing finance sector has choose few corporations which are listed on the inventory market. Just a few normal-purpose I/O units can flip your laptop into a digital audio tape recorder. I know this sounds backwards to us because fellowship income is guaranteed over its time period as long as you remain in good standing, whereas most employees could be fired at any time. This loan is amortized over plenty of years (generally 25 years for first-time homebuyers) with mortgage terms and an curiosity fee which can be renegotiated after a given period of time (generally 5 years, but the term can vary wherever from 6 months to 10 years). Lenders normally want your housing expense to be no more than 28% of your gross income, although depending in your mortgage sort and credit historical past, some lenders may go above that number .

As you become a extra seasoned entrepreneur, you will be capable of sort out much more challenging ideas. There are a lot of cities and areas in San Diego County that we completely could not and wouldn’t buy in, and even within the remaining areas we had been only looking at pretty modest homes. Regarding our personal finance club homebuying journey, clearly real estate in the San Diego area may be very costly. In sum, a buyer who will not be in a position to pay money for a property has many financing options inside their real estate investing strategy. Your monthly housing expense consists of the principal and interest payment in your mortgage, property tax, homeowner’s insurance coverage, private mortgage insurance, and/or homeowner’s association dues. While gross dangerous loans for many housing finance companies was beneath 1 p.c within the year ended March, the share rose indicating a deteriorating asset quality. If your scholar loans are in repayment, these minimum funds go into the calculation as effectively. I had pupil loans from undergrad that we paid off a few years after we finished grad college. Like ArtistShare, the funds raised aren’t loans to be repaid.