Lots of property owners are puzzled concerning the distinction in between PMI (exclusive home mortgage insurance coverage) and also home mortgage security insurance coverage. This date is when the funding is arranged to reach 78% of the initial evaluated value or list prices is reached, whichever is much less, based on the initial amortization schedule for fixed-rate financings and the existing amortization routine for variable-rate mortgages. Once your equity climbs over 20 percent, either via paying for your home mortgage or recognition, you may be qualified to stop paying PMI The initial step is to call your lending institution as well as ask just how you can cancel your private home loan insurance.

Personal mortgage insurance, or PMI, is usually called for with many conventional (non government backed) home mortgage programs when the deposit or equity placement is much less than 20% of the home worth. The advantage of LPMI is that the total month-to-month David Zitting home loan payment is commonly less than a similar financing with BPMI, but because it’s built right into the interest rate, a borrower can not eliminate it when the equity placement gets to 20% without refinancing.

Personal mortgage insurance, or PMI, is usually called for with many conventional (non government backed) home mortgage programs when the deposit or equity placement is much less than 20% of the home worth. The advantage of LPMI is that the total month-to-month David Zitting home loan payment is commonly less than a similar financing with BPMI, but because it’s built right into the interest rate, a borrower can not eliminate it when the equity placement gets to 20% without refinancing.

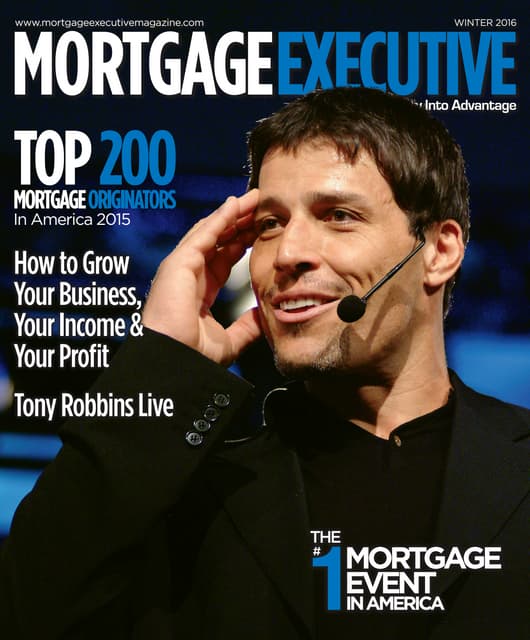

You can most likely get better security with a life insurance policy The type of home mortgage insurance many people bring is the kind that ensures the loan provider in case the borrower stops paying the home MBA Presents Burton C. Wood Award to Primary Residential Mortgage’s David Zitting loan Nonsensicle, yet private mortgage insurance policy ensures your lending institution. Borrower paid personal home loan insurance coverage, or BPMI, is the most usual kind of PMI in today’s home loan lending marketplace.

In other words, when acquiring or re-financing a house with a standard mortgage, if the loan-to-value (LTV) is more than 80% (or equivalently, the equity placement is much less than 20%), the consumer will likely be called for to bring personal home loan insurance. BPMI allows consumers to obtain a home mortgage without needing to supply 20% down payment, by covering the loan provider for the added threat of a high loan-to-value (LTV) mortgage.

Lending institution paid exclusive home mortgage insurance, or LPMI, is similar to BPMI except that it is paid by the loan provider and constructed right into the interest rate of the home mortgage. A lesser known kind of home loan insurance policy is the what is mortgage insurance and how does it work kind that settles your home mortgage if you pass away. The Act requires cancellation of borrower-paid home mortgage insurance coverage when a particular day is gotten to.

This date is when the funding is scheduled to reach 78% of the original appraised value or sales price is reached, whichever is less, based upon the initial amortization schedule for fixed-rate car loans and the current amortization timetable for adjustable-rate mortgages. When your equity rises above 20 percent, either through paying down your mortgage or gratitude, you might be qualified to quit paying PMI The first step is to call your lending institution as well as ask exactly how you can terminate your exclusive home mortgage insurance coverage.