SoFi is a charge-less online lender offering a number of various kinds of loans. You can apply for a personal mortgage, a home mortgage, scholar loans or refinancing. SoFi also presents several funding merchandise and spending accounts. You may also use SoFi as a credit score monitoring device or to apply for small enterprise financing.

Before using DDTLs expanded to include a number of functions, they would typically be used to finance a single acquisition made recognized to the lender prior to the closing date of the loan. Therefore, the commitment length of the delayed draw interval can be set to match the closing of the acquisition in consideration. It might usually be three months, where the corporate was limited to 1 drawing of funds to consummate the acquisition.

Product types and most loan amounts differ by market. Subject to state rules, eligibility, credit verify, underwriting and approval. Charges, terms and conditions apply. Title loans subject to minimum auto worth requirements. See associate for details. Lending selections and funding times subject to system limitations. Some purposes may require further verification, which may delay the lending choice.

– Availability of different capital funding channels

– Customer centricity

– Mature danger and regulatory landscape

– Streamlined operations of buyer-facing personnel

– Strong credit score threat assessment mechanisms

– Technology enablement for the ‘high-touch’ business

– Women empowerment and the emergence of an entrepreneurship-pushed panorama

Totally different Fashions of Microfinance in India

– Loan amounts range from $2,000 to $35,000

– Mortgage term lengths range between 2 to 5 years

– Administration price of up to 4.75%, which will probably be deducted from your mortgage proceeds when the loan is funded, and late charge that varies by state

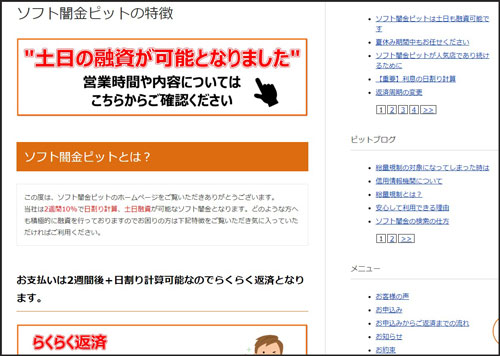

– Loans made by WebBank, 即日融資可能なソフト闇金えびすはこちら member FDIC