Numerous house owners are puzzled concerning the distinction between PMI (exclusive home loan insurance policy) as well as home loan defense insurance. This day is when the finance is scheduled to reach 78% of the original evaluated worth or prices is gotten to, whichever is less, based upon the original amortization routine for fixed-rate financings and the current amortization schedule for adjustable-rate mortgages. As soon as your equity rises over 20 percent, either via paying for your mortgage or recognition, you could be eligible to stop paying PMI The first step is to call your lender as well as ask just how you can terminate your exclusive home mortgage insurance.

Numerous house owners are puzzled concerning the distinction between PMI (exclusive home loan insurance policy) as well as home loan defense insurance. This day is when the finance is scheduled to reach 78% of the original evaluated worth or prices is gotten to, whichever is less, based upon the original amortization routine for fixed-rate financings and the current amortization schedule for adjustable-rate mortgages. As soon as your equity rises over 20 percent, either via paying for your mortgage or recognition, you could be eligible to stop paying PMI The first step is to call your lender as well as ask just how you can terminate your exclusive home mortgage insurance.

It seems unAmerican, however that’s what occurs when you obtain a mortgage that exceeds 80 percent loan-to-value (LTV). Consumers erroneously think that exclusive mortgage insurance makes them special, but there are no personal solutions provided with this sort of insurance David Zitting policy. Not only do you pay an upfront costs for home mortgage insurance coverage, however you pay a regular monthly premium, along with your principal, rate of interest, insurance coverage for home coverage, as well as taxes.

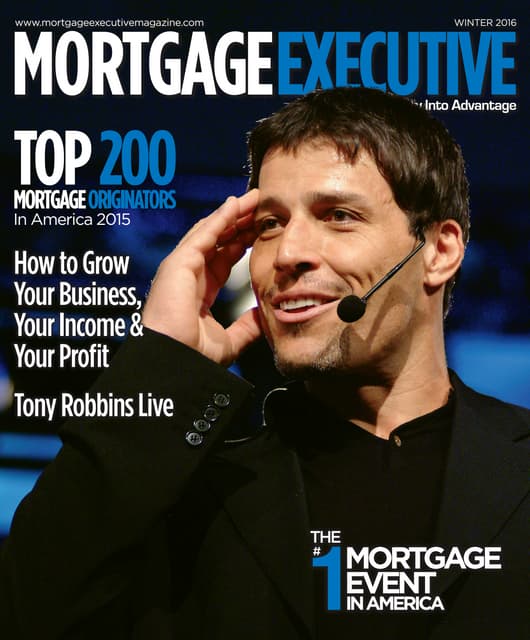

Yes, exclusive mortgage insurance offers zero defense for the consumer. You don’t choose the home loan insurer and you can not negotiate the costs. The one that everybody whines about Primary Residential Mortgage Reviews is personal home loan insurance (PMI). LPMI is usually an attribute of car loans that claim not to require Home loan Insurance policy for high LTV finances.

Home mortgage Insurance coverage (additionally known as home loan guarantee as well as home-loan insurance policy) is an insurance plan which makes up lending institutions or financiers for losses as a result of the default of a mortgage loan Home mortgage insurance policy can be either public or personal relying on the insurance company. On the various other hand, it is not required for proprietors of private homes in Singapore to take a home mortgage insurance policy.

Lender paid exclusive mortgage insurance coverage, or LPMI, is similar to BPMI except that it is paid by the lending institution and also built into the rates of interest of the mortgage. A lesser known kind of home loan insurance policy is the MBA Presents Burton C. Wood Award to Primary Residential Mortgage’s David Zitting kind that settles your home mortgage if you pass away. The Act requires cancellation of borrower-paid home mortgage insurance coverage when a particular day is gotten to.

This date is when the lending is set up to reach 78% of the original evaluated value or prices is reached, whichever is less, based upon the original amortization schedule for fixed-rate financings and the current amortization routine for variable-rate mortgages. When your equity rises over 20 percent, either with paying for your mortgage or admiration, you could be qualified to quit paying PMI The first step is to call your lender as well as ask how you can cancel your exclusive home loan insurance policy.