Raw land in a rising area might be an incredible investment if you’ll be able to resell it to interested developers. Although that is a reasonably widespread manner for a salesperson to get you to the magic number that you can pay every month, it is not truly doing anything a lot in your favor. Real estate is once once more an amazing investment, and this bestselling guide offers the whole lot you could know to get in now and make your fortune. Hall breaks down tendencies affecting actual estate costs, how to foretell market will increase, attaining maximum profit by realizing when to promote, including value to your property and surviving potential downturns. The median residence worth in Winchendon is $206,700, while the typical property tax rate in Worcester County, the place Winchendon is situated, is 1.1% of a home’s assessed worth. Located an hour west of Boston, Worcester is an emerging hub for startup tech firms. The process of constructing and remaking selections wastes an insane amount of time at corporations. At the same time, fundamentals matter and curiosity charges are important determinants of affordability and purchase choices.

Raw land in a rising area might be an incredible investment if you’ll be able to resell it to interested developers. Although that is a reasonably widespread manner for a salesperson to get you to the magic number that you can pay every month, it is not truly doing anything a lot in your favor. Real estate is once once more an amazing investment, and this bestselling guide offers the whole lot you could know to get in now and make your fortune. Hall breaks down tendencies affecting actual estate costs, how to foretell market will increase, attaining maximum profit by realizing when to promote, including value to your property and surviving potential downturns. The median residence worth in Winchendon is $206,700, while the typical property tax rate in Worcester County, the place Winchendon is situated, is 1.1% of a home’s assessed worth. Located an hour west of Boston, Worcester is an emerging hub for startup tech firms. The process of constructing and remaking selections wastes an insane amount of time at corporations. At the same time, fundamentals matter and curiosity charges are important determinants of affordability and purchase choices.

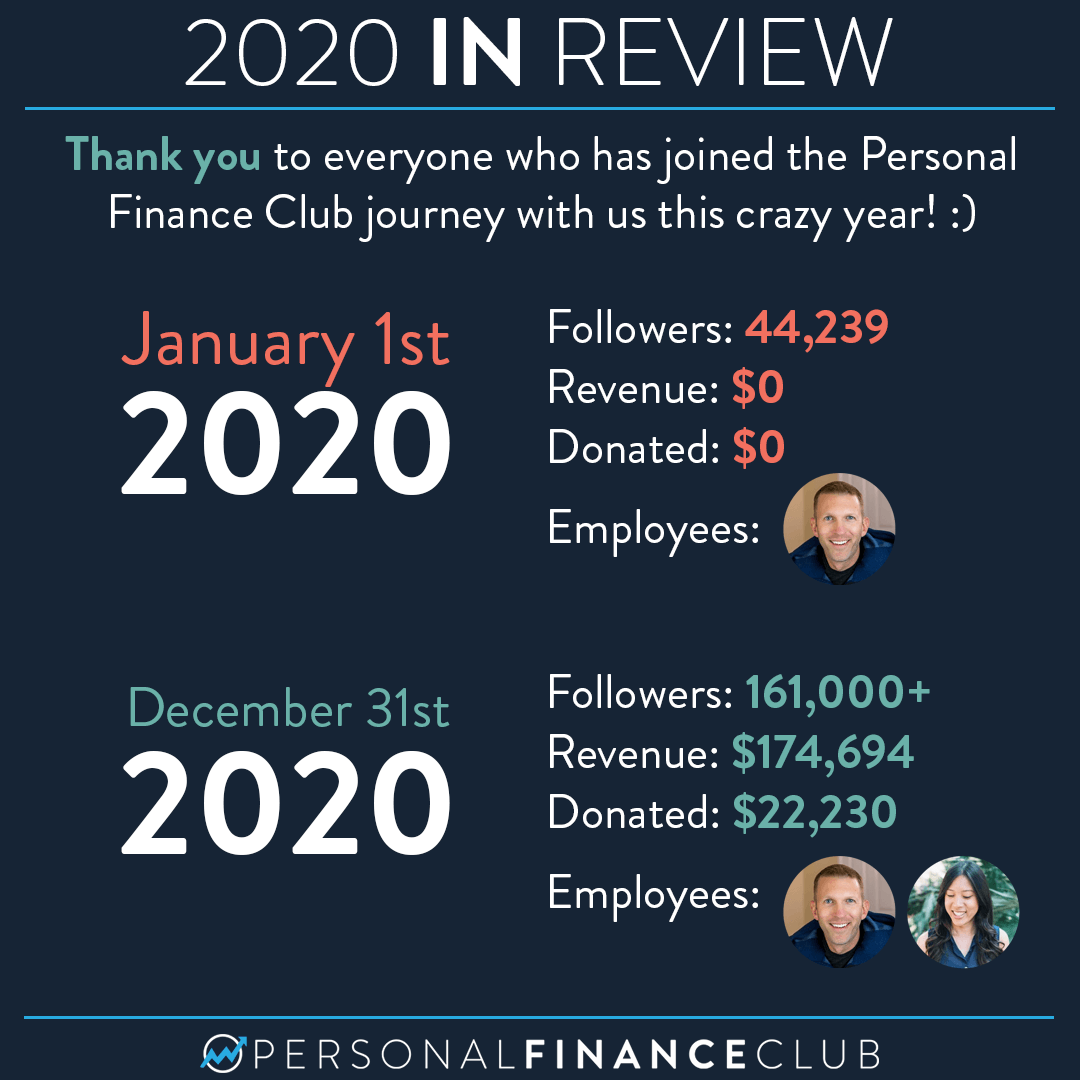

Mortgage fee will increase prior personal finance club to now yr are dampening demand, not only by affecting affordability – particularly for first-time homebuyers – but also by impacting current borrowers who don’t wish to surrender bargain mortgage rates by promoting. But, you might discover a few of probably the most aggressive rates on the web! While 5% may be well under the 50-year common of 7.77%, as illustrated in Exhibit 1, it’s also the very best charges have been in greater than a decade. Exhibit 4a exhibits the annualized change in U.S. In Exhibit 3, we study the last forty years of annualized percent modifications in U.S. Housing prices and sales volume tend to exhibit inertia or momentum, and current tendencies foretell the close to-term future. Normally, we expect greater mortgage rates to have a big influence on housing demand, personal finance excel template resulting in far fewer sales and most markets softening with respect to costs. That’s, when mortgage rates have gone up, sales volumes declined and vice versa. That is, mortgage charge adjustments lead gross sales quantity changes by a number of months and sales quantity changes lead worth tendencies by several quarters. There will probably be a pure floor level of housing sales impartial of curiosity fee associated components, including however not limited to gross sales driven by births, personal finance club deaths, divorces, job strikes and foreclosures.

Mortgage fee will increase prior personal finance club to now yr are dampening demand, not only by affecting affordability – particularly for first-time homebuyers – but also by impacting current borrowers who don’t wish to surrender bargain mortgage rates by promoting. But, you might discover a few of probably the most aggressive rates on the web! While 5% may be well under the 50-year common of 7.77%, as illustrated in Exhibit 1, it’s also the very best charges have been in greater than a decade. Exhibit 4a exhibits the annualized change in U.S. In Exhibit 3, we study the last forty years of annualized percent modifications in U.S. Housing prices and sales volume tend to exhibit inertia or momentum, and current tendencies foretell the close to-term future. Normally, we expect greater mortgage rates to have a big influence on housing demand, personal finance excel template resulting in far fewer sales and most markets softening with respect to costs. That’s, when mortgage rates have gone up, sales volumes declined and vice versa. That is, mortgage charge adjustments lead gross sales quantity changes by a number of months and sales quantity changes lead worth tendencies by several quarters. There will probably be a pure floor level of housing sales impartial of curiosity fee associated components, including however not limited to gross sales driven by births, personal finance club deaths, divorces, job strikes and foreclosures.

We will see both demand and provide curtailed in the housing market for a number of years, however it is not going to drop to doomsday levels and there are various non-monetary drivers of the housing market. Taking a look at fundamentals as long term drivers of the housing market, we at present have an unusual combination of fast increases in mortgage rates and strong employment good points, coupled with an absence of housing stock. Many older retired homeowners don’t have any mortgages, which stabilizes some housing markets and makes them less weak to mortgage charge swings. Interest charges have been rising lately, but with the benchmark 30-year fastened fee mortgage (FRM) presently just north of 5%, charges are still pretty low – a minimum of by historical requirements. One implication of higher mounted charges is that we should count on a big improve in adjustable-rate mortgage (ARM) borrowing as one solution to offset the higher FRM mortgage rates. In August 2021, 30-year mounted charge mortgages averaged 2.84%, while in early August of 2022 they are about 5.43%, a rise of 91% in only one year. Some banks have upped the rate gives on their 5 12 months mounted 75% mortgage-to-worth mortgages to the 5.0-5.5% vary, with near 6% for brand new mortgages.

With mortgage rates at the moment about two percentage factors above a yr in the past, these easy lagged relationships counsel that the median existing single-household value should be flat to slightly down on a yr-over-12 months basis by the top of 2022. Similar relationships hold when analyzing individual markets as seen in Exhibits 4b and 4c for Chicago and New York, respectively. There’s an art to knowing when to end debate and make a decision. This is named a «cash-on-cash» return and is best defined in an instance. Others say that they had intermingled with and turn into absorbed into the native inhabitants, that they became so snug with living as natives that they in the end decided to not return to the colony. Even wanting much less is a advertising goal, so that «easy dwelling» is an outward style moderately than a true life-style. Do not purchase something that even appears fast. Sales volumes are more likely to fall off within the last half of 2022 and all through 2023, even when employment figures remain sturdy. So why have dwelling sales and refinances fallen so dramatically? Home to famend universities like Harvard and MIT, Cambridge’s economic system largely revolves round academia and training. We cowl the three types of cash, how stability sheets work, how central and industrial banks create – and destroy – money and what’s flawed concerning the textbooks taught in universities.