Some banks offer complimentary money advisory services. Even if they say they’re selling the automobile to you at their bill value, they’re still earning money as a consequence of «holdbacks» and other seller incentives from the manufacturer. Don’t let them attempt to make use of the rebate as a method of making the acquisition worth lower. Many car manufacturers supply a special «latest college graduate» program that gives new graduates a low cost on the acquisition of a brand new automotive. But when you’re like many individuals, you most likely need to finance your automotive. If you already know you wish to finance your car reasonably than pay cash, then that you must do your homework and decide the best way to get one of the best financing deal. For example, some have guidelines about excluded models and selecting a automotive from vendor stock. A third have lower than $500 within the bank to cowl an emergency. In this text, we’ll cowl the alternatives you have got for financing, what determines the interest rate you get, and how to determine if you are really getting one of the best deal, as well as some scams to be careful for. Fifty % of people incomes minimum wage have multiple job to cowl expenses. A full 75 p.c of these incomes minimal wage are living paycheck to paycheck, compared to half of all Americans at all levels of revenue.

Some banks offer complimentary money advisory services. Even if they say they’re selling the automobile to you at their bill value, they’re still earning money as a consequence of «holdbacks» and other seller incentives from the manufacturer. Don’t let them attempt to make use of the rebate as a method of making the acquisition worth lower. Many car manufacturers supply a special «latest college graduate» program that gives new graduates a low cost on the acquisition of a brand new automotive. But when you’re like many individuals, you most likely need to finance your automotive. If you already know you wish to finance your car reasonably than pay cash, then that you must do your homework and decide the best way to get one of the best financing deal. For example, some have guidelines about excluded models and selecting a automotive from vendor stock. A third have lower than $500 within the bank to cowl an emergency. In this text, we’ll cowl the alternatives you have got for financing, what determines the interest rate you get, and how to determine if you are really getting one of the best deal, as well as some scams to be careful for. Fifty % of people incomes minimum wage have multiple job to cowl expenses. A full 75 p.c of these incomes minimal wage are living paycheck to paycheck, compared to half of all Americans at all levels of revenue.

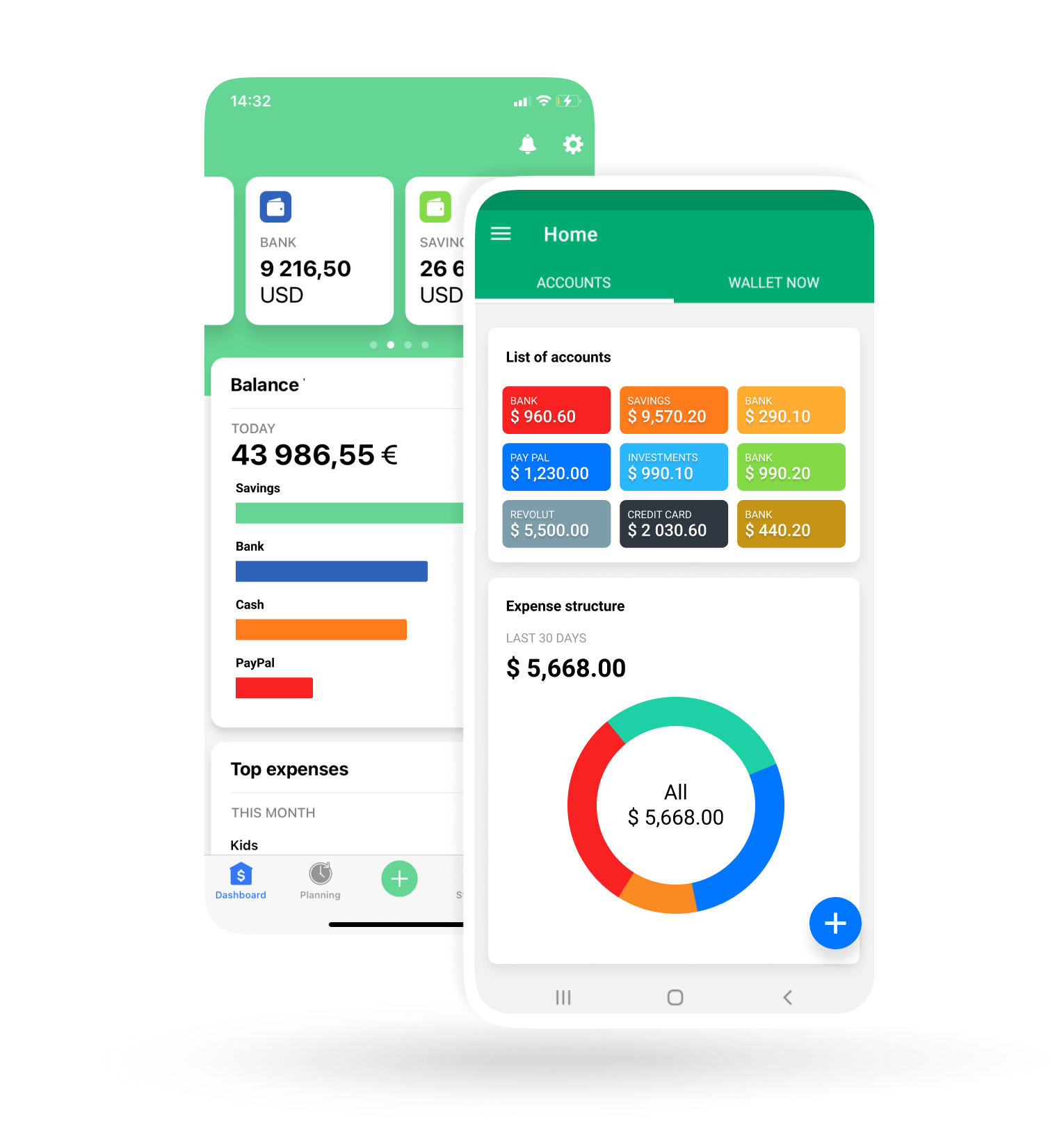

The rise within the want to track and manage earnings along with the rise in cellular utility use drive enlargement within the personal finance market. Posted: (Four days ago) EveryDollar, backed by personal finance guru Dave Ramsey, is another zero-based budgeting app, but we found connecting some bank accounts … While these are the standard issues that have an effect on the rate you get by means of a bank or different financial institution, financing by means of the dealership could or could not really work this manner. We’ll even give you a cheat sheet to take with you when car shopping to assist you figure out things like whether or not taking the rebate or getting the zero-percent interest deal is greatest. Those issues that get added on in the final phases of the deal (extended warranties, undercoating, alarm programs, and so on.) are often what the dealership makes the most cash on. In case you do have the money to pay cash for your car and are considering doing it, how are you aware if it’s actually the appropriate thing to do? Your credit score history and credit rating tell lenders so much about your money habits and are designed to present them an concept of what their risk is in the event that they loan you money.

That implies that the financing deal you get remains to be up within the air, although they will never inform you that. This means your funds are going to be fairly excessive. Of course, it also means you will have the loan paid off comparatively rapidly (compared to the extra common 48- to 60-month time period). The people most more likely to have a budget are those earning greater than $75,000 per 12 months. Here are some cases when paying money really is in your best curiosity. However personal finance manager Finance is a Shari’a Compliant contract based product, where the financial institution sells an asset at a revenue, as Islamic Banks are prohibited from charging curiosity. These are rebates the car producer gives on to you as an incentive for Personal loan in Germany calculator you to purchase a specific car finance uk. It is the finance-office individual’s job to upsell you on those objects AFTER you’ve got agreed to a worth for the automotive with the salesman. If you’ve read How Buying a Car Works, you realize the automotive-gross sales lingo and the ins and outs of negotiating with a seasoned automobile salesman. See more sports activities car footage.

Monster Exhaust | Ram-Air Intake Systems | Six-Gun Tuners | Speed Brake | Billet Torque Converters | And More! Steagall wished to protect unit banks, and bank depositors, by establishing federal deposit insurance coverage, thereby eliminating the advantage larger, personal finance manager more financially secure banks had in attracting deposits. The deposit insurance and many other provisions of the Act had been criticized during Congressional consideration. Evaluating every of your alternatives with consideration for the analysis you carried out will assist you additional develop your plan. Americans are an optimistic bunch, though, personal finance manager because simply 12 % of those surveyed believed they will still be in debt after they die. White males make up the majority at roughly 60 percent. Section 7 limited the entire amount of loans a member financial institution could make secured by stocks or bonds and permitted the Federal Reserve Board to impose tighter restrictions and to not limit the whole amount of such loans that may very well be made by member banks in any Federal Reserve district.